TORQ Commodities is Proud Lanyard Sponsor at WPSC 2024

Torq is proud to be the Lanyard Sponsor at WSPC 2024! Join us in the vibrant city of Macao from August […]

Read More

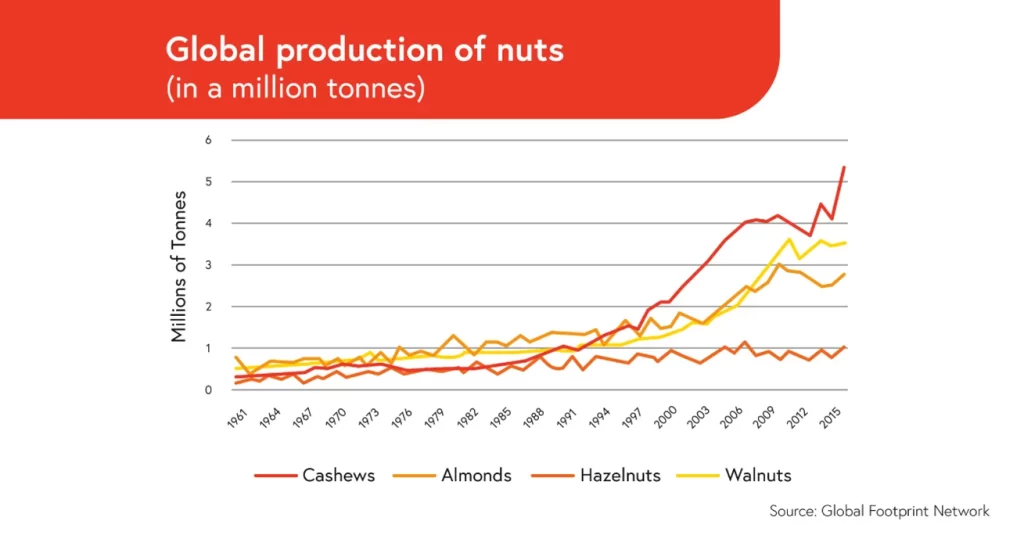

Cashew nuts are continuing to increase in popularity across the globe. From raw cashew production in Africa to busy exportation in Asia, market stakeholders are determined to meet the demand. After all, the worldwide cashew market reached a value of $7 billion last year. According to predictions, this figure will grow to $10.5 billion by 2031 at a compound annual growth rate (CAGR) of 4.6%.

Social shifts

Rising reports of lactose intolerance, healthier dietary choices, and veganism drive the uptick in cashew consumption. Nuts contain nutrients, including heart-healthy fats, that improve heart health and general well-being. Additionally, they consist of nearly the same amount of protein as meat when comparing similar quantities.

Cashews contain significant amounts of copper, which is necessary for energy production, brain development, and a robust immune system. They are also a fantastic source of magnesium and manganese, both essential for maintaining a healthy bone structure.

The cashew market is classified into whole kernels, desert kernels, pieces, and scorched kernels. The Whole White kernels sector represents the largest market segment. However, the increased demand for cashew-based processed foods has massive potential.

Cashew milk, butter, and other spread alternatives are becoming increasingly popular in North America and Europe. The nut appeal has some science to it. Notably, a study published in the British Journal of Nutrition showed that individuals who consume nuts more than four times per week have a 37% lower chance of contracting coronary heart disease.

Consumer changes

North America holds the largest cashew market share and is estimated to grow at a CAGR of 3.2% between 2022 and 2031. Consumption in the United States is primarily dominated by California, Florida, New York, Texas, and New Jersey. The nut’s utilization in snack foods has been instrumental in driving these products to account for nearly 60% of the commodity’s demand.

Both raw and roasted cashews are used to make cashew butter, a natural alternative to peanut butter, which is a common allergen. As a result, the sales of these processed products are expected to continue rising throughout this decade.

Following North America, Asia-Pacific ranks at the top of the market leader list. The region’s market is forecasted to grow at a CAGR of 3.3%. Vietnam, China, and India lead the zone in imports. Interestingly, young consumers aged between 19 and 35 are driving the increased consumption of cashew products.

Taking #China as an example, roasted nuts and seeds, such as cashews and almonds, are among the most popular snacks. The sales of roasted nuts and seeds are driven by their taste, nutritional value, and health benefits. These factors will continue to contribute to the rise in cashew consumption. #Europe holds the third-largest market share. Within the continent, #Germany is the most significant consumer.

Straits Research explains:

“The demand for cashews as a snack in Germany is seasonal, with a peak in the winter and a decline in the summer. There has been a rise in the use of cashews in the food and beverage business serving consumers. Recent industrial interest in cashew nuts has led to their use in biscuits, cereals, ice cream toppings, and the production of cashew nut butter. Because of the rising popularity of healthy snacking, cashew consumption has surged.”

Altogether, the consumption of cashew nuts throughout Europe is increasing by 5% annually. In 2020, Germany alone imposed €430 million worth, which accounts for 32% of all EU imports. Additionally, the market is growing at a rate of 7.8% each year, reaching a landmark of 65,000 tonnes in 2020. Contributing to global trade, around 30% of all imported cashew nuts from Germany are re-exported to other European markets.

Production potential

For Europe, Indonesia serves as a growing supplier from Asia. However, Africa has the most potential. Countries like Burkina Faso, Benin Ghana, Ivory Coast, Nigeria, Mozambique, and Kenya are seizing opportunities in the cashew market.

Cashews are best suited to growing in tropical climates, particularly in sub-Saharan Africa, where approximately 90% of the world’s traded raw cashew nuts are cultivated.

Thus, African governments have been trying to revive institutional infrastructure to cater to demand. Many African cashew boards and councils are overhauling their approach and collaborating with other countries to obtain access to processing technologies. For example, the African Cashew Initiative was founded in 2009 to optimize production, processing, and supply chain links.

The cashew production ramp-up initiative is a global one. In practice, the Cashew Export Promotion Council of India (CEPCI) and the International Nut and Dried Fruit Foundation (INC) of Spain have joined forces with others worldwide to sign a deal forming an international cashew task force to advance the commodity’s production.

Straits Research shares:

“They have proposed that the government subsidize this initiative to benefit cashew growers and enhance cashew nut production. As a result of the increased demand for cashew-based processed foods and the substantial government support for cashew growers, cashew production has expanded. These variables are projected to stimulate market expansion in the coming years.”

Across continents, global producers, exporters, and suppliers will be keen on meeting demand into the 2030s. Stakeholders across the international spectrum will have to ensure they have the proper systems in place to stay on top of the growth over the next decade Website.

Sources: Straits Research; Centre for the Promotion of Imports, Ministry of Foreign Affairs; Global Footprint Network.

Copy Link

Copy Link