TORQ Commodities is Proud Lanyard Sponsor at WPSC 2024

Torq is proud to be the Lanyard Sponsor at WSPC 2024! Join us in the vibrant city of Macao from August […]

Read More

Global tastes are becoming spicier. Markets across the continents are increasing their demand for chillies. With this trend, around four million tonnes of dried chillies and peppers are being produced each year.

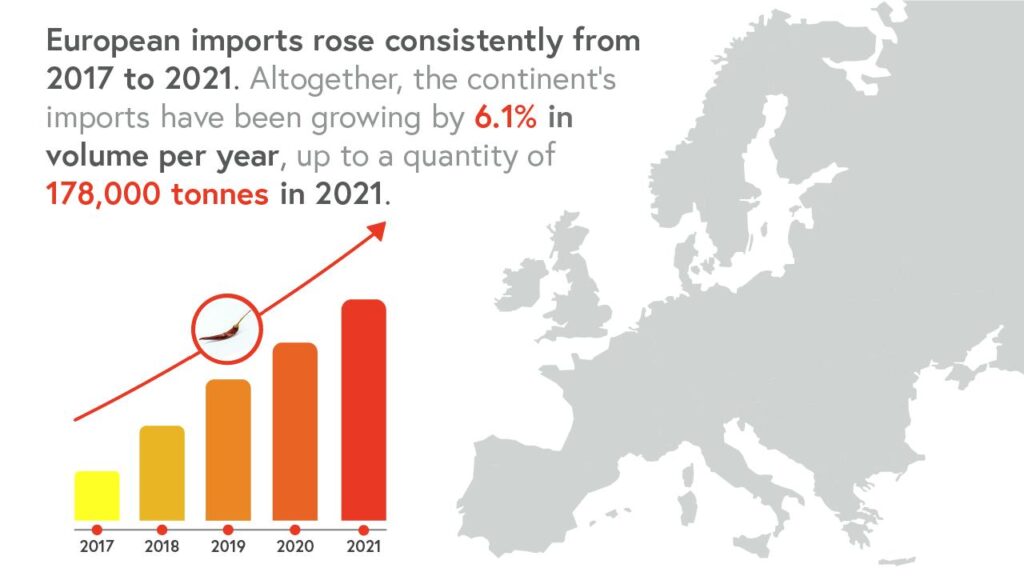

While Asia has long been a chilli-consuming stronghold, there is a potential significant demand worldwide. For instance, Europe is the world’s second-largest importer of dried chillies, making up approximately 40% share of total imports.

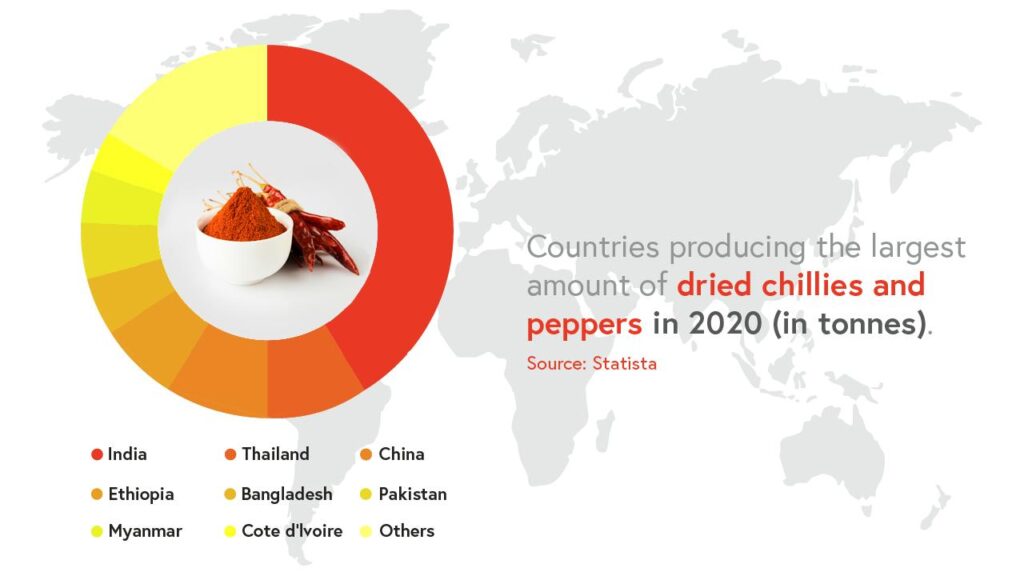

India tops the list with 1,702,000 tonnes of dried chilli and peppers produced in 2020. However, last year saw the price of the nation’s chillies rise amid heavy rain and high domestic demand. Prices increased by 50% in September 2022.

The prices remain high into 2023, with Kashmiri red chillies costing more than almonds per kilogram. India’s farmers will be keen to address shortage challenges into the summer.

Nonetheless, India will remain a production powerhouse. As Statista puts it:

“India is by far the world’s biggest producer of dried chilis and peppers, the Food and Agriculture Organization category which comes closest to describing varieties of hot peppers that are often dried

and sold whole or as a powder. In 2020, the latest year available, India produced more than 1.7 million tonnes of dried chilli and pepper varieties – far ahead of second-placed Thailand and third-placed China. The latter country is a big importer of Indian hot chilis, which it uses to fill its high domestic demand.”

South Asia dominates across the board. Bangladesh ranked fifth in 2020, producing approximately 158,000 tonnes. Pakistan followed with 142,000 tonnes. Pakistan has also been dealing with shortage difficulties amid heatwaves and floods.

Thailand and Myanmar round off the other Asian countries on the list. Meanwhile, Ethiopia and Cote d’Ivoire represent Africa.

Countries producing the largest number of dried chillies and peppers in 2020 (in tonnes). Photo: Statista

It’s clear to see that India has a grip on the dried chilli and pepper market. However, the country’s presence in the spice trade is well spread. It has an 80% share of the global turmeric production. It is also second to #China when it comes to garlic production.

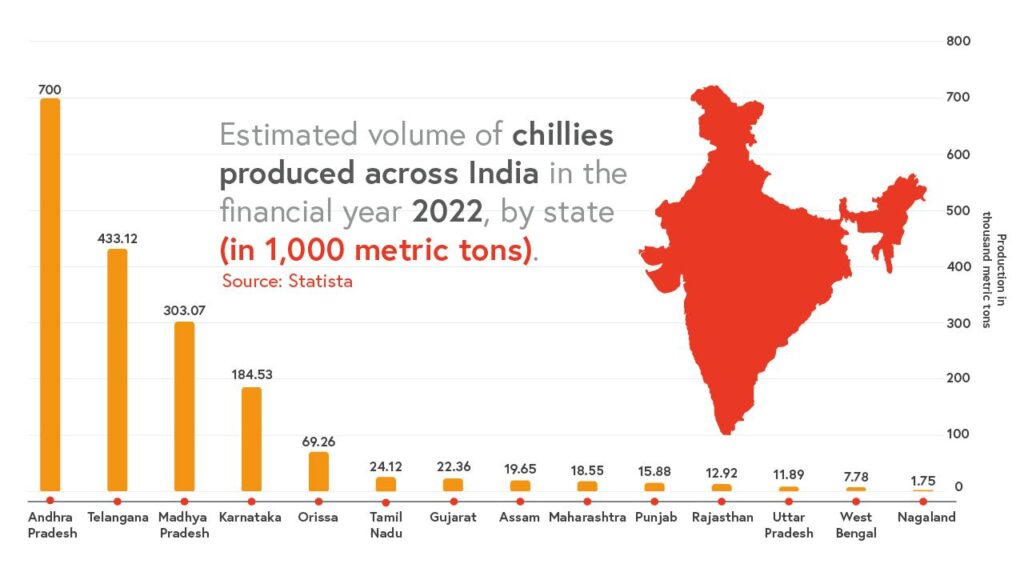

Overall, India is the leader in spice growing in the world, holding a share of around 36% in global chilli production. Andhra Pradesh is the state that contributes the most to this figure, with a 57% share in total production.

Chillies represented over 130 billion Indian rupees in the Indian economy during the fiscal year of 2020. This figure was lower than the previous year’s contribution of chillies from the country. However, the onset of the pandemic may have contributed to this shift.

Subsequently, estimates for 2022 are promising. It’s estimated that Andhra Pradesh produced 700,000 MT (metric tonnes) of chilli last year. Telangana follows in second with 433,000 MT. Madhya Pradesh and Karnataka are also taking a large share, accounting for 303,000 MT and 184,000 MT of the estimates, respectively.

Orissa, Tamil Nadu, Gujarat, Assam, Maharashtra, Punjab, Rajasthan, Uttar Pradesh, West Bengal, and Nagaland are all estimated to have contributed a portion each to India’s overall production.

Estimated volume of chillies produced across India in the financial year 2022, by state (in 1,000 metric tons). Photo: Statista

Looking ahead

The demand for chillies will continue into the second half of 2023, with the likes of the United States, Sri Lanka, Malaysia, Vietnam, Indonesia, and Singapore heavily importing the commodity. China itself is even a major importer despite being a strong producer.

Torq Commodities exports the world’s spiciest Teja chillies from the southern state of Andhra Pradesh to China. Despite the numerous challenges that the chilli market in India is currently facing, we work tirelessly to provide our clients with the finest quality chillies, which involves a rigorous on-ground quality inspection.

Europe will be the key international player taking on India’s spices in this next chapter. Notably, The United Kingdom is the leading European importer of Indian chillies.

UK imports grew by 7.5% in value each year between 2017 and 2021, totalling around 16 thousand tonnes.

The Centre for the Promotion of Imports (CBI) shares:

“The United Kingdom’s imports are influenced significantly by Indian supplies. This is mainly due to the country’s large Indian community, as dried chillies are often used in traditional Indian recipes. Indian is among the most common non-UK nationalities in the UK at 795,000 inhabitants in 2022, and it continues to expand as India is also the most common non-UK country of birth for UK citizens.”

In practice, The UK imports 32% of its dried chillies from India, second to Spain, which had 35% of total imports. Another primary supplier to the UK is China, with a 9.5% share in imports.

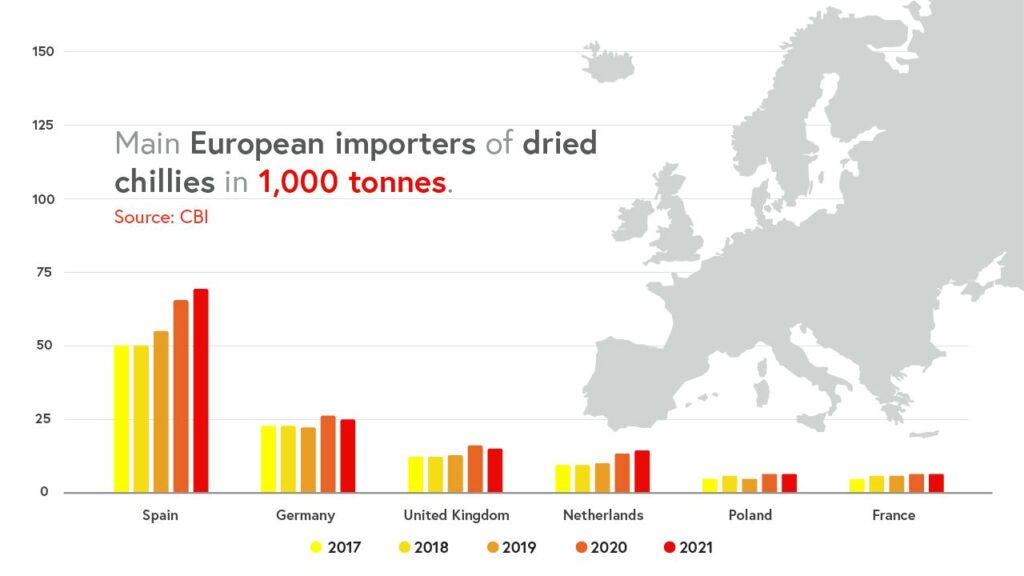

Even though Spain imports plenty of dried chillies to the UK, it is Europe’s main importer of the commodity, taking on nearly 75,000 tonnes in 2021. Germany is in second place with 25,000 tonnes imported in 2021. The Netherlands, Poland, and France are also key importers.

Main European importers of dried chillies in 1,000 tonnes. Photo: CBI It will be a major challenge to meet chilli demand amid climate and output constraints. Regardless, the need for chillies is set to continue rising in this decade patners.

Copy Link

Copy Link